Reliance Jio Infocomm may have dethroned incumbents to become India’s new telecom market leader, but its ambitious target may force it to compromise on pricing for some more time.

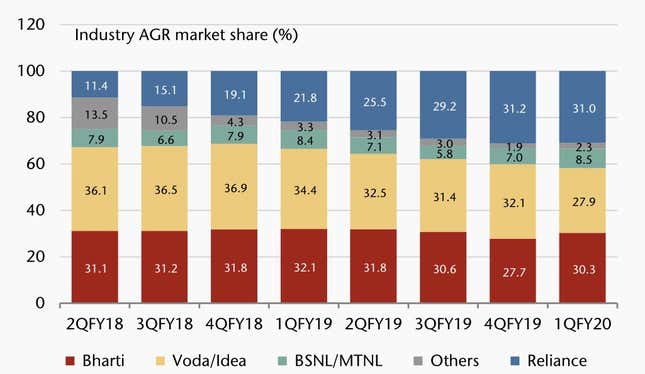

In the April-June quarter, Jio snatched the top spot in terms of revenue market share from Vodafone-Idea, according to a note from the consultancy Jefferies India, which cited data from the Telecom Regulatory Authority of India (TRAI). The company accounted for nearly a third of the sector’s total revenue in the three-month period.

Earlier this month, Mukesh Ambani, India’s richest man and founder of Jio, said the telecom firm had crossed 340 million subscribers, becoming the top telecom player in the country by number of subscribers as well.

Despite the success, the company might struggle to make money in the future, analysts say.

Big goals, low tariffs

At the time of Jio’s soft launch in December 2015, Ambani had set a target of reaching 100 million subscribers in a year.

To get there, the company kicked off a price war when it formally launched in September 2016, offering throwaway tariffs and forcing competitors to drive down their rates. The result: Ambani’s 100 million subscriber target was achieved in just six months of the public launch.

Now, the company has set another ambitious goal of capturing a revenue market share of 50%. That, analysts say, might be a challenge.

Though the firm is now in the top spot, “we believe that price hikes are unlikely in the financial year ending March 2020, and will happen only once Jio becomes the dominant player with 40% plus revenue market share which we expect in the financial year ending March 2021,” Jefferies India analysts Piyush Nahar and Pratik Chaudhuri said in the note.

Most of Jio’s new additions will come at the cost of Vodafone-Idea, which was formed after the merger of Vodafone India and Idea, both of which were left battered after Jio’s entry. While the merged entity’s revenue market share is expected to fall to around 20% by the financial year ending March 2021, from 28% currently, the other standing telecom giant, Bharti Airtel, will maintain its steady share at around 30%, the analysts added.