They have some of the best minds in their universities watching their money. But in recent years, the endowments of schools in the Ivy League and its peer institutions have generated subpar returns. The fiscal year ending in June 2018 looks promising, however. MIT’s endowment earned a 13.5% return, University of Pennsylvania got 12.9%, Yale’s 12.3%, and Harvard (typically behind the others) earned 10%—net of fees. Still, this may not be as impressive as it sounds: the S&P 500 earned about 12% too.

Endowments are the savings accounts of universities, and the returns the funds generate helps pay for research, salaries, and financial aid. Ivy League endowments can be staggeringly large —Harvard’s reached $39 billion—and that money gives the institutions the financial muscle to maintain their supremacy in higher education.

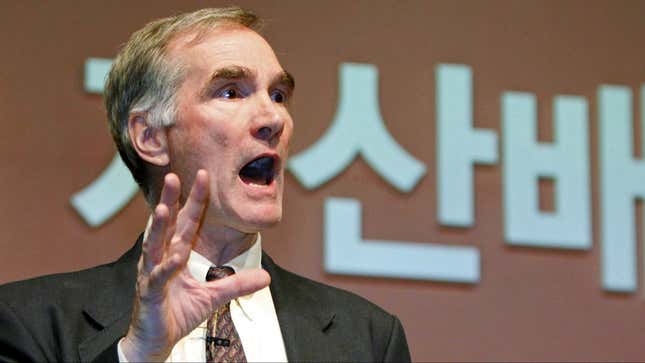

Ivy League endowment strategies have changed a lot over the years. The intellectual force behind it all is David Swensen, Yale’s chief investment officer who has been working for the endowment since 1985. The men running the endowments at MIT and Penn are his proteges. Swensen tends to favor alternative investments; that is, assets not available in public markets like hedge funds and private equity.

In 1987, most of Yale’s portfolio—90%—was allocated to marketable American securities, like public stocks, bonds, and cash. Today only 10% of its endowment is invested in these kinds of assets. The rest is in hedge funds, private equity, foreign stocks, and real estate. An astounding 50% of Yale’s endowment is invested in these types of illiquid, high-fee alternative assets.

In exchange for the fees and locking up your money, these funds promise higher returns and they might. But it is hard to tell. Investing in private equity and venture capital funds means committing your money for a few years while the fund invests in private companies. The funds offer internal rate of return estimates bases on how their assets are performing, but asset performance can be subjective and hard to measure when the investments are not sold in a public market. The endowments all claim high returns from their private equity investments. Indeed, getting to post high returns on hard-to-value assets may be part of the appeal, since endowment managers are judged (and paid) based on their annual returns. But long-term, it is not clear these assets are really worth the opacity and illiquidity.

A successful endowment manager doesn’t just beat their peers. Great managers maintain healthy returns in any kind of market. The real test of this investment strategy will be if all these investments in venture capital, leveraged buy-out firms, and hedge funds pay off when the market inevitably drops. Similar assets bought before and during the last financial crisis did not do very well. But this time could be different.

Institutional investors tend to follow fads. Right now the fad is illiquid private markets, and if they hold up during the next recession we can expect more to come. If not we might see a return to plain old stocks.