- News

- Business News

- India Business News

- Santoor 1st desi soap to hit Rs 2,000cr sales

Trending

This story is from June 26, 2019

Santoor 1st desi soap to hit Rs 2,000cr sales

Namrata Singh | TNN

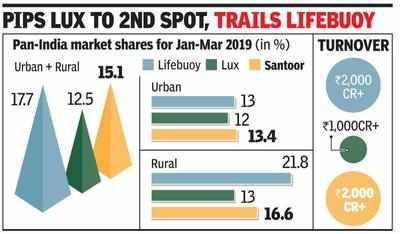

Mumbai: Santoor has become the first soap brand from an Indian FMCG company to breach annual sales of Rs 2,000 crore. Wipro Consumer Care, the maker of Santoor, confirmed the number to TOI. With a turnover of over Rs 2,000 crore, Santoor has clearly overtaken HUL’s soap brand Lux, and is now challenging the numero uno Lifebuoy. HUL’s latest annual report places Lifebuoy and Lux in the Rs 2,000-crore and Rs 1,000-crore plus sales bracket, respectively.

Wipro Consumer Care and Lighting CEO Vineet Agrawal said, “Santoor has grown consistently across urban and rural markets. It is now among the Rs 2,000-crore plus consumer brands — first and only Indian soap brand to do so.”

According to industry sources quoting Kantar Household panel data, Santoor’s all-India market share in January-March 2019, at 15.1%, has exceeded Lux’s 12.5%, but is less than Lifebuoy’s 17.7%. The urban market data, however, shows Santoor (13.4%) ahead of both Lux (12%) and Lifebuoy (13%). Kantar declined to comment on this data.

Insights into data from Worldpanel Division of Kantar reveal that Santoor’s penetration is much higher than Lux in South and parts of West regions. However, at a national level, Santoor has a much lesser penetration than Lux (34% against 60%).

Lux’s penetration is driven by the Rs 10-pack (about 55g), with 60% of Lux-buying homes purchasing this pack. On the other hand, Santoor’s penetration is driven largely by its 75g+ pack, with 70% of Santoor-buying homes purchasing this pack. According to the data from Worldpanel Division of Kantar, Santoor also has a higher number of buying occasions than Lux (Santoor buyers purchase about 45% more times than Lux buyers). As a result, the overall volumes of Santoor have gone ahead of Lux in recent times.

Mumbai: Santoor has become the first soap brand from an Indian FMCG company to breach annual sales of Rs 2,000 crore. Wipro Consumer Care, the maker of Santoor, confirmed the number to TOI. With a turnover of over Rs 2,000 crore, Santoor has clearly overtaken HUL’s soap brand Lux, and is now challenging the numero uno Lifebuoy. HUL’s latest annual report places Lifebuoy and Lux in the Rs 2,000-crore and Rs 1,000-crore plus sales bracket, respectively.

Wipro Consumer Care and Lighting CEO Vineet Agrawal said, “Santoor has grown consistently across urban and rural markets. It is now among the Rs 2,000-crore plus consumer brands — first and only Indian soap brand to do so.”

According to industry sources quoting Kantar Household panel data, Santoor’s all-India market share in January-March 2019, at 15.1%, has exceeded Lux’s 12.5%, but is less than Lifebuoy’s 17.7%. The urban market data, however, shows Santoor (13.4%) ahead of both Lux (12%) and Lifebuoy (13%). Kantar declined to comment on this data.

Industry sources quoting Nielsen data said Santoor (9.3%) is the third-largest brand after Lifebuoy (13.7%) and Lux (12%) for January-March 2019. When contacted, an HUL company spokesperson said, “Lux continues to be the second-largest soap brand in India after Lifebuoy. As a policy, we do not comment on market shares.”

Insights into data from Worldpanel Division of Kantar reveal that Santoor’s penetration is much higher than Lux in South and parts of West regions. However, at a national level, Santoor has a much lesser penetration than Lux (34% against 60%).

Lux’s penetration is driven by the Rs 10-pack (about 55g), with 60% of Lux-buying homes purchasing this pack. On the other hand, Santoor’s penetration is driven largely by its 75g+ pack, with 70% of Santoor-buying homes purchasing this pack. According to the data from Worldpanel Division of Kantar, Santoor also has a higher number of buying occasions than Lux (Santoor buyers purchase about 45% more times than Lux buyers). As a result, the overall volumes of Santoor have gone ahead of Lux in recent times.

End of Article

FOLLOW US ON SOCIAL MEDIA