- India

- International

Govt could use RBI excess funds for big capital push in time of slowdown: Top official

Surplus funds received from RBI will not be used on the revenue account but rather to push up capital investment in the economy, the official indicated.

The additional spending leeway is important in the wake of investment remaining tepid and private consumption growth tapering off.

The additional spending leeway is important in the wake of investment remaining tepid and private consumption growth tapering off.

The government has lined up a “big” capital expenditure programme to utilise the excess funds received from the Reserve Bank of India, a top Finance Ministry official told The Indian Express.

Surplus funds received from RBI will not be used on the revenue account but rather to push up capital investment in the economy, the official indicated. Apart from Rs 70,000 crore upfront capital infusion into public sector banks announced last week, a renewed spending push from the Centre could be the stimulus to counter the economic slowdown.

“We have a big expenditure programme lined up over the next few months and the money received from RBI will be used to fund that and in turn provide a fillip to the economy,” the official said.

The additional spending leeway is important in the wake of investment remaining tepid and private consumption growth tapering off. The increased government spending will boost economic activity as other engines of growth – investment, consumption and exports – have slowed.

But there are also concerns about the Centre’s ability to direct these funds for optimal utilisation given the experience in the past with the use of disinvestment proceeds and the cess raised on various counts.

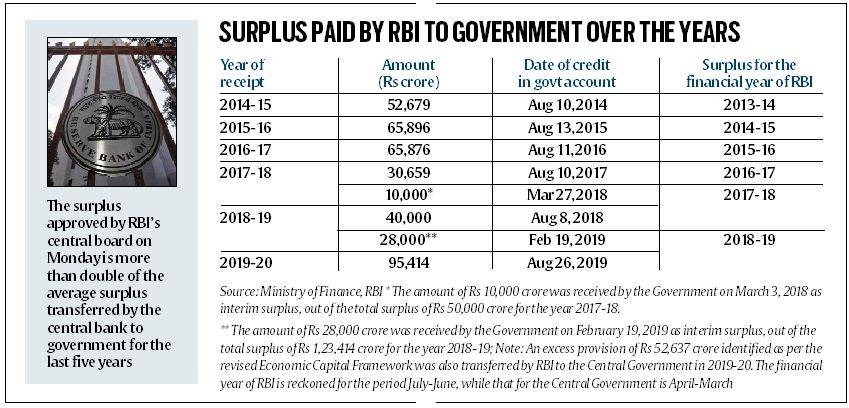

The government will get an additional Rs 58,000 crore as compared to Rs 90,000 crore accounted for as surplus transfer from the RBI in the Union Budget 2019-20, for spending in the current financial year. Since the RBI had already paid Rs 28,000 crore as interim dividend to the government last year, the Centre will be left with Rs 1.48 lakh crore out of Rs 1.76 lakh crore for the current financial year.

Editorial | India’s banking industry needs a design change

This stimulus will be effective if the government is able to meet its revenue targets from taxes and non-tax receipts. Any shortfall in the Centre’s earnings could negate the effect of additional spending, assuming the government adheres to the fiscal deficit roadmap outlined in the budget.

Amid growing concerns over the weak direct tax revenue collections of the government — subdued in the first five months of the year — there are questions over the government’s ability to push expenditure. Even as the move takes away a part of RBI’s war chest, experts say, it provides the government with a much-needed resource that if utilised properly may provide a stimulus to the economy.

This could also arrest the slowdown in government spending. The Centre has already started the year by spending less – in the first three months of the 2019-20, 61.4 per cent of the budgeted fiscal deficit has been utilised, 7.3 percentage points lower than the comparable target a year ago, as lower capital expenditure took place as revenues declined.

Explained | In economic slowdown, a back story about falling investor confidence

The steady slide in investment activity has been progressively intensifying – evidenced by a nearly 30 per cent drop in capital expenditure by the government in the June 2019 quarter.

Tax revenue growth is also turning out to be far slower than the required run rate, reflective of the consumption slowdown in the economy. The government’s net revenue growth from direct taxes has decelerated sharply to 4.7 per cent for April 1-August 15 this year as against a required annual growth rate of 17.3 per cent, reflecting lower buoyancy in the wake of an overall slowdown in the economy.

With the sharply slower revenue growth, the government’s direct tax targets are looking out of reach for the second consecutive year.

The additional funds from the government will provide a fiscal cushion to the government to boost spending. Rashesh Shah, Chairman and CEO of Edelweiss Group, said that other than fast forwarding capitalisation of banks and expediting capital expenditure, the government should also look to provide tax break in GST etc. to build a consumption demand in the economy.

“It will be crucial that the funds are directed towards means aimed at fuelling investment and consumption demand to bring the growth cycle back on track,” said a senior official. He cautioned that the money should not be utilised to meet government’s revenue expenditure or to fund unproductive loans.

May 10: Latest News

- 01

- 02

- 03

- 04

- 05